국제투기자본의 힘 (달러)로 큰 중국; 점점 달러 비중이 줄어들고 위안화 비중이 높아지는건 중국보고 성장통을 거치고 자립하라는 신호; 장기적으로 보면 국제투기자본은 2030년대, 2050년대 G2 시대를 기획하고 있다

국제투기자본의 힘 (달러)로 큰 중국; 점점 달러 비중이 줄어들고 위안화 비중이 높아지는건 중국보고 성장통을 거치고 자립하라는 신호; 장기적으로 보면 국제투기자본은 2030년대, 2050년대 G2 시대를 기획하고 있다

https://www.visualcapitalist.com/sp/hf02-start-of-de-dollarization-chinas-gradual-move-away-from-the-usd/

The Start of De-Dollarization: China’s Move Away from the USD

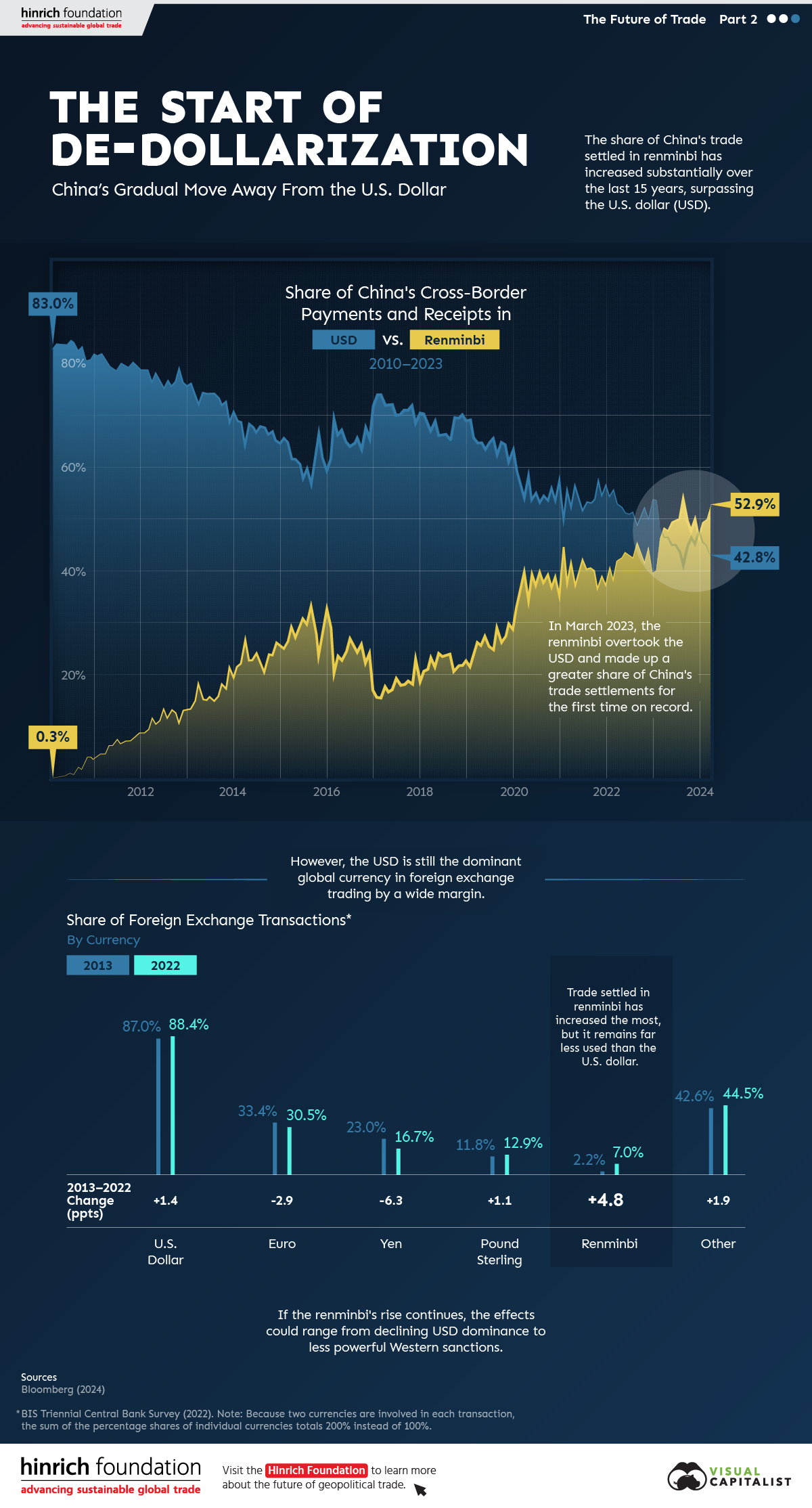

Since 2010, the majority of China’s cross-border payments, like those of many countries, have been settled in U.S. dollars (USD). As of the first quarter of 2023, that’s no longer the case.

This graphic from the Hinrich Foundation, the second in a three-part series covering the future of trade, provides visual context to the growing use of the Chinese renminbi (RMB) in payments both domestically and globally.

The De-Dollarization of China’s Cross-Border Transactions

This analysis uses Bloomberg data on the share of China’s payments and receipts in RMB, USD, and other currencies from 2010 to 2024.

In the first few months of 2010, settlements in local currency accounted for less than 1.0% of China’s cross-border payments, compared to approximately 83.0% in USD.

China has since closed that gap. In March 2023, the share of the RMB in China’s settlements surpassed the USD for the first time.

| Date | Renminbi | U.S. Dollar | Other |

|---|---|---|---|

| March 2010 | 0.3% | 84.3% | 15.4% |

| March 2011 | 4.8% | 81.3% | 13.9% |

| March 2012 | 11.5% | 77.1% | 11.5% |

| March 2013 | 18.1% | 72.7% | 9.2% |

| March 2014 | 26.6% | 64.8% | 8.6% |

| March 2015 | 29.0% | 61.9% | 9.0% |

| March 2016 | 23.6% | 66.7% | 9.7% |

| March 2017 | 17.6% | 72.5% | 9.9% |

| March 2018 | 23.2% | 67.4% | 9.4% |

| March 2019 | 26.2% | 65.1% | 8.7% |

| March 2020 | 39.3% | 54.4% | 6.3% |

| March 2021 | 41.7% | 52.6% | 5.6% |

| March 2022 | 42.1% | 53.3% | 4.7% |

| March 2023 | 48.4% | 46.7% | 4.9% |

| March 2024 | 52.9% | 42.8% | 4.3% |

Source: Bloomberg (2024)

Since then, the de-dollarization in Chinese international settlements has continued.

As of March 2024, over half (52.9%) of Chinese payments were settled in RMB while 42.8% were settled in USD. This is double the share from five years previous. According to Goldman Sachs, foreigners’ increased willingness to trade assets denominated in RMB significantly contributed to de-dollarization in favor of China’s currency. Also, early last year, Brazil and Argentina announced that they would begin allowing trade settlements in RMB.

Most Popular Currencies in Foreign Exchange (FX) Transactions

Globally, analysis from the Bank for International Settlements reveals that, in 2022, the USD remained the most-used currency for FX settlements. The euro and the Japanese yen came in second and third, respectively.

| Currency | 2013 | 2022 | Change (pp) |

|---|---|---|---|

| U.S. Dollar | 87.0% | 88.5% | +1.5 |

| Euro | 33.4% | 30.5% | -2.9 |

| Yen | 23.0% | 16.7% | -6.3 |

| Pound Sterling | 11.8% | 12.9% | +1.1 |

| Renminbi | 2.2% | 7.0% | +4.8 |

| Other | 42.6% | 44.4% | +1.8 |

| Total | 200.0% | 200.0% |

Source: BIS Triennial Central Bank Survey (2022). Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100%.

The Chinese renminbi, though accounting for a relatively small share of FX transactions, gained the most ground over the last decade. Meanwhile, the euro and the yen saw decreases in use.

The Future of De-Dollarization

If the RMB’s global rise continues, the stranglehold of the USD on international trade could diminish over time.

The impacts of declining dollar dominance are complex and uncertain, but they could range from the underperformance of U.S. financial assets to diminished power of Western sanctions.

However, though the prevalence of RMB in international payments could rise, a complete de-dollarization of the world economy in the near- or medium-term is unlikely. China’s strict capital controls that limit the availability of RMB outside the country, and the nation’s sputtering economic growth, are key reasons contributing to this.

The third piece in this series will explore Russia’s shifting trading patterns following its invasion of Ukraine.

Comments

Post a Comment