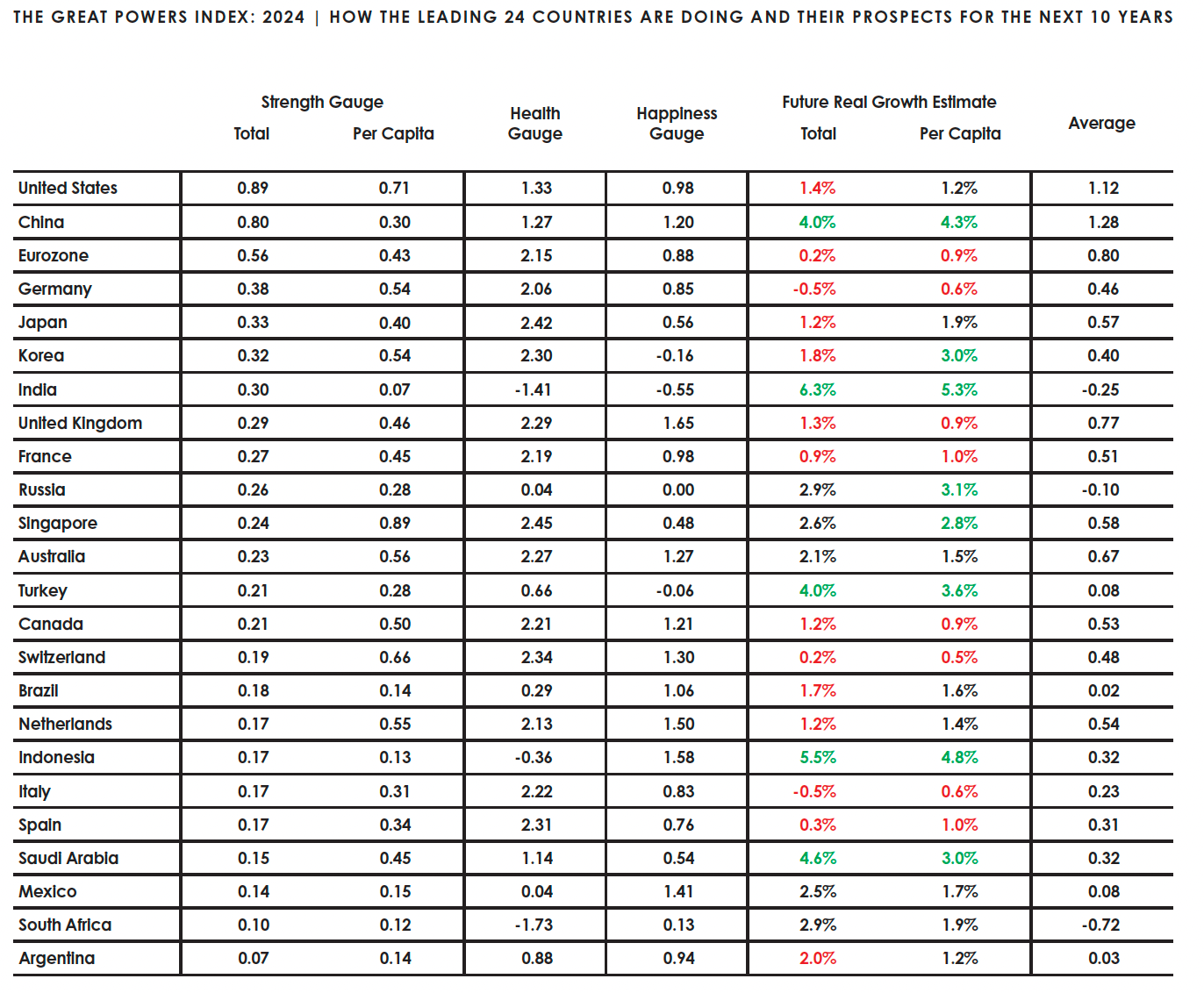

레이 달리오가 분석한 세계 국력 지수: 미국, 중국, 유럽연합, 독일, 일본, 한국, 인도, 영국, 프랑스, 러시아 순

세계 최대 헤지펀드 CEO이자 ‘투자의 전설’ 레이 달리오. 거시경제 지표를 바탕으로 투자하는 ‘매크로 투자’의 대가인 그가 얼마 전 세계 주요 국가의 경쟁력을 분석한 ‘’를 발표해 화제입니다.

세계 국력 지수 살펴보기

자료를 보면 미국이 1위, 중국이 2위로 뒤를 바짝 따르고, 한국은 6위로 일본의 뒤를 따르고 있습니다. 하지만 입니다. 순위만 본다면 미국이 1위지만, 지표 옆에 추세를 나타내는 화살표를 보면 수치가 감소하는 흐름임을 알 수 있어요. 일본의 감소세는 더 가파른 것으로 볼 수 있습니다. 반면, 임을 알 수 있습니다.

‘세계 국력 지수’는 레이 달리오가 최근 저서 에서도 자세히 분석한 바 있습니다. 달리오는 수많은 데이터를 참고해 이 지표를 만들었습니다. 각 나라가 '빅 사이클'의 어느 단계에 있는지 예측하기 위해서입니다. 좀 더 보기 편하도록 책에 실린 번역자료를 살펴보겠습니다.

이 자료에서 했습니다. 표의 첫 번째 열은 ‘총 제국 점수’를 결정하는 요인을 보여주고, 두 번째 열은 지표의 신뢰성을 ‘좋음, 보통’ 등으로 나타냅니다. 몇몇 요인은 명확한 측정값이 있지만(교육, 혁신 및 기술, 가격 경쟁력 등), 몇몇은 그렇지 못하므로(자연재해 등) 이를 구분하기 위해서입니다.

레이 달리오는 이 표로 고 말합니다. 예를 들어, ‘제국 점수’와 화살표를 보아 중국은 모든 영역에서 미국을 바짝 뒤쫓고 있지요. 하지만 기축통화 지위, 통치 체제/법치 등의 요소는 여전히 취약합니다.

점점 악화되는 요인이 많아질수록 해당 국가는 더욱 확실하게 쇠퇴의 길을 가게 된다는 것이 달리오의 주장입니다. 이 자료를 보면 현재 고 그는 경고합니다.

믿을 만한 자료일까?

레이 달리오는 이것이 “매우 유용한 정보”라고 말합니다. 현재 일어나고 있는 현상과 앞으로 일어날 사건을 가늠할 수 있기 때문이지요. 달리오는 했습니다. 결과는 어땠을까요? 향후 10년 내 국가의 실제 성장률을 했고(오차범위 2% 이내에서는 약 90%), 였습니다.

하지만 미래를 정확히 예측하는 것은 신의 영역이겠지요. 달리오 역시 이 자료는 매우 유용하지만, “미래를 정확히 맞출 수 있다는 것은 아니다”라고 말합니다. 그럼에도 경제와 세계 질서에 어떤 흐름이 있는 것은 분명하므로, 책 <변화하는 세계 질서>를 통해 고 강조합니다.

https://raisini.substack.com/p/how-the-top-24-countries-are-shaping

How the Top 24 Countries Are Shaping the World Over the Next Decade and How it Affects Your Health and Happiness

The Great Power Shifts - Understanding Ray Dalio’s Global Power Index 2024 with 10 Key Takeaways

This is an opinion piece on Ray Dalio’s - The Great Powers Index: 2024 : How the Leading 24 Countries Are Doing and Their Prospects for the Next 10 Years

A PDF of his essays can be downloaded here or on his website.

Why Understanding Global Power is Crucial

If you’ve been keeping an eye on the news, you know the world is changing at a rapid pace. Whether it’s the tensions between the U.S. and China, the rise of India, or Europe’s economic struggles, these global dynamics impact our lives in ways we might not even realize. If you're wondering why your investments are volatile or where the next big growth market is, geopolitics might hold the answers.

Ray Dalio’s Global Power Index provides a comprehensive view of the world’s 24 leading countries, measuring their strength, health, happiness, and projected growth over the next decade. It gives us a clear understanding of which countries are gaining power, which are losing it, and why this matters to you.

Whether you’re a business leader, an investor, or someone thinking about where you and your family might live, understanding global power shifts is essential. It helps you make informed decisions about your financial future, your well-being, and even where your children will thrive.

Big Picture: Global Power Shifts You Need to Watch

The Global Power Index gives us a window into the forces shaping today’s world. There’s a lot to take in, but I’ll break it down for you. The big takeaway? Global power is shifting dramatically, and understanding these shifts can help you stay ahead of the curve.

1. The U.S.-China Rivalry: A New Kind of Cold War?

The U.S. remains the world’s strongest country, but China is catching up fast. Dalio’s Index shows that while the U.S. still leads in military power, innovation, and financial markets, China’s rapid economic growth and increasing influence in global trade make it the U.S.’s biggest competitor. Over the next decade, China is expected to grow at an impressive 4%, compared to just 1.4% for the U.S.

However, this rivalry isn’t just about numbers. It’s about dominance in technology, trade partnerships, and military presence. China’s Belt and Road Initiative, which has extended its influence into Africa, Latin America, and Southeast Asia, is a clear indicator that China is playing the long game.

Why does this matter to you? Because if tensions between these two superpowers escalate, it will affect everything from the stock market to global supply chains. Think about how recent trade wars between the U.S. and China impacted technology companies, or how geopolitical conflicts influence the cost of goods. Whether you’re an investor or just trying to stay informed, this rivalry will shape the world’s future.

2. The Rise of India: The Next Big Economic Engine

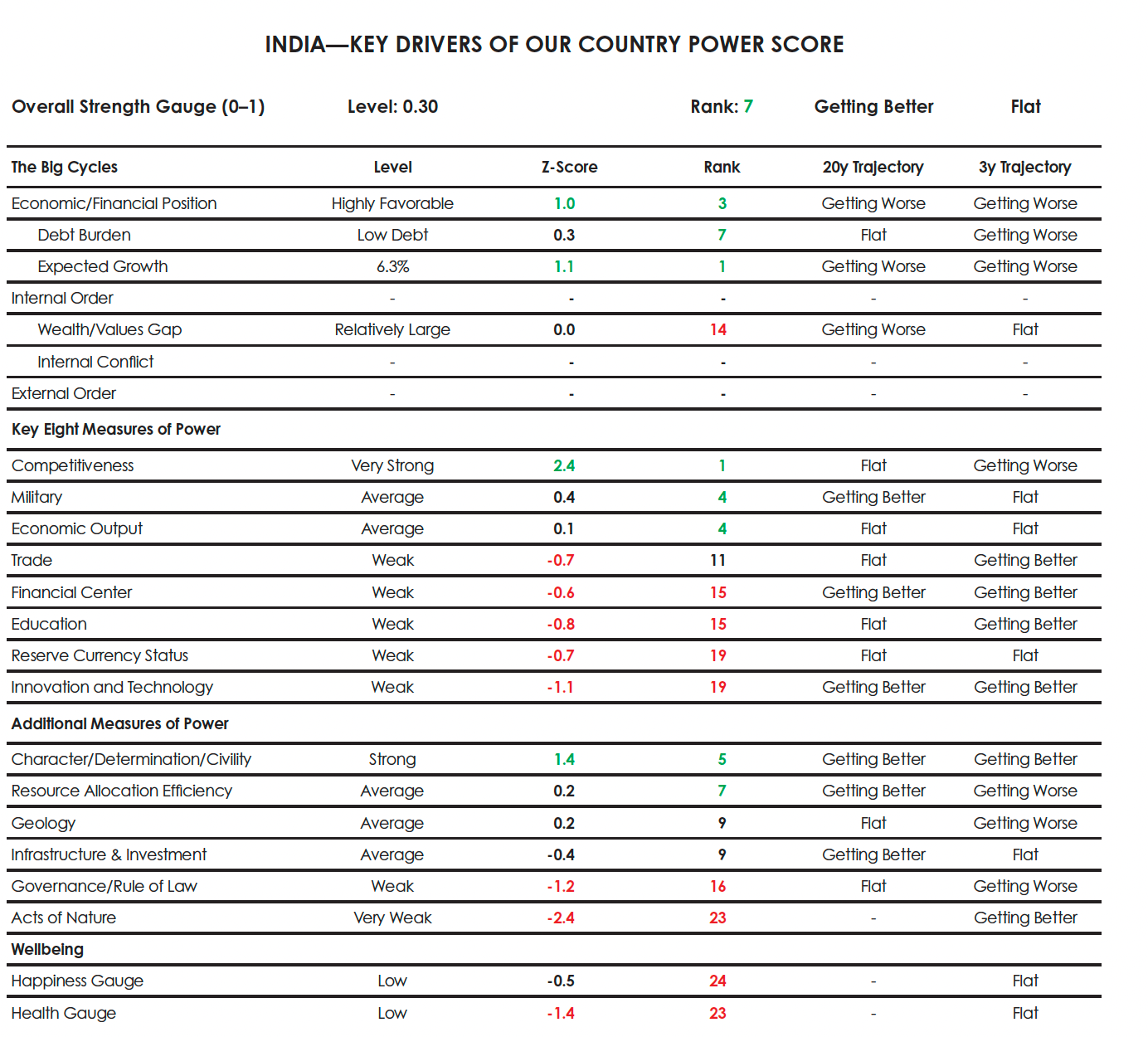

If you’re looking for the next big growth story, India might be it. Dalio’s Index projects India’s economy to grow at over 6% annually over the next decade. That’s faster than any other major economy, including China. India’s young, expanding workforce and booming tech sector make it a magnet for foreign investment.

But there’s a downside. While India’s economic growth is impressive, it ranks last in happiness and near the bottom in health. Dalio points out that despite rapid economic development, India struggles with severe inequality, a high disease burden, and poor quality of life for much of its population. If these social issues aren’t addressed, they could act as a brake on India’s long-term growth.

For businesses and investors, India presents a high-reward, high-risk opportunity. Yes, there’s immense potential, but there are also significant challenges related to infrastructure, governance, and social unrest. However, with the right reforms, India could become a global powerhouse in the coming decades.

3. Europe: Economic Stagnation and Political Uncertainty

Europe, particularly the Eurozone, faces significant challenges. Germany, France, and other major European economies are struggling with low growth rates, aging populations, and political fragmentation. According to Dalio’s projections, the Eurozone is expected to grow at just 0.2% annually over the next decade, a far cry from the growth seen in the U.S. or Asia.

One of the key reasons for Europe’s economic stagnation is its demographic crisis. With birth rates declining and life expectancy increasing, many European countries are grappling with shrinking workforces and rising pension costs. Additionally, the European Union’s cumbersome regulatory environment and political divisions make it difficult to implement the kind of sweeping reforms needed to jumpstart growth.

Despite these challenges, Europe still plays a critical role in the global economy. Germany remains one of the world’s largest exporters, and France is a leader in industries like aerospace, energy, and luxury goods. But for investors and businesses, Europe may not offer the same high-growth opportunities as markets like India or Southeast Asia.

The Major Determinants Across the World

In Dalio’s framework, global power is not just about military might or economic size. It’s about a wide range of factors that together determine a country’s influence on the world stage. Here’s a breakdown of the key determinants that shape global power, according to Dalio’s Index.

1. Economic Strength

Economic strength remains a foundational determinant of global power. This is measured by GDP, trade volume, and market size. Countries like the U.S., China, and Germany continue to dominate here, but emerging economies like India are gaining ground. Dalio emphasizes that economic strength is not just about total size but also per capita metrics, which is why smaller countries like Switzerland still rank high.

2. Military Power

While military strength is less decisive than it once was, it’s still a crucial component of national power. The U.S. spends more on its military than any other country, accounting for nearly 40% of global military spending. China, while behind the U.S., is rapidly expanding its military capabilities, particularly in the Asia-Pacific region. For countries like Russia, military power remains one of their few remaining levers of influence on the world stage.

3. Innovation and Technology

Countries that lead in technology and innovation will define the future of global power. Dalio’s Index ranks the U.S. and China as the leaders in innovation, but countries like South Korea, Japan, and Singapore are not far behind. As we move into an era defined by artificial intelligence, biotechnology, and renewable energy, nations that dominate these sectors will have a significant edge.

4. Governance and Rule of Law

Strong governance and a well-functioning legal system are key to maintaining national power. Dalio’s Index shows that countries with robust rule of law—like Switzerland, Canada, and the Netherlands—tend to have more stable economies and higher levels of happiness and health. On the flip side, countries with weak governance and high levels of corruption—like Brazil and South Africa—face greater instability.

5. Natural Resources and Geography

Countries with abundant natural resources have a strategic advantage. Saudi Arabia, for instance, remains a global power due to its vast oil reserves, despite its smaller economy. Geography also plays a role; countries like the U.S. and Russia benefit from their large landmasses and diverse climates, while smaller nations must focus on maximizing efficiency and innovation.

Health and Happiness Scores: A Window into Well-Being

Dalio’s Index doesn’t just measure economic or military power—it also takes into account health and happiness, key indicators of a nation’s overall well-being. These scores are crucial because they reflect the quality of life in a country, which in turn affects its long-term stability and growth prospects.

1. The Health Score

The health score in Dalio’s Index looks at life expectancy, access to healthcare, pollution levels, and other indicators. Unsurprisingly, countries with strong healthcare systems like Japan, Switzerland, and Singapore rank at the top. The U.S., despite its wealth, ranks much lower due to issues like obesity, pollution, and unequal access to healthcare. Meanwhile, developing countries like India and South Africa struggle with high rates of disease and lower life expectancy.

2. The Happiness Score

Happiness is measured through a combination of subjective and objective factors. Countries like the Netherlands, Switzerland, and the United Kingdom score high in happiness, thanks to their strong social safety nets, low levels of corruption, and high standards of living. On the other hand, countries like India and Russia rank lower due to higher levels of poverty, inequality, and social unrest. Interestingly, China ranks higher than the U.S. on happiness, suggesting that economic growth alone doesn’t guarantee a satisfied population.

3. What It Means for You

Why should you care about health and happiness scores? Because they provide insight into the long-term viability of a country. A nation with high economic growth but low happiness and health (like India) may face future social instability. Meanwhile, countries that balance economic growth with high levels of well-being (like Switzerland or the Netherlands) are more likely to offer stable environments for investment and living.

Country Snapshots: Strengths, Weaknesses, and What the Future Holds

The United States: A Superpower Facing Internal Challenges

The U.S. remains the world’s strongest power, but Dalio’s Index highlights several vulnerabilities. Internal conflict, rising debt, and slowing economic growth all pose significant risks. However, the U.S. still dominates in military power, innovation, and global finance. It’s a nation in transition, and its future depends on how well it can manage its internal divisions and external challenges.

China: The Fastest Riser

China’s rapid rise has been one of the defining stories of the 21st century. Its economy is projected to grow at 4% annually, and it’s making significant strides in technology and innovation. However, China also faces challenges, particularly in terms of high debt levels and rising external conflict risks. As China continues to expand its global influence, it will be critical to watch how it manages its domestic issues and international relationships.

India: The Future Economic Powerhouse

India’s projected growth of over 6% makes it the fastest-growing economy in the Index. Its young, growing workforce and expanding tech sector make it a magnet for investment. But India’s low rankings in health and happiness show that it still has significant social issues to address. For long-term investors, India offers high rewards, but also high risks.

Europe: Stagnation and Resilience

Europe’s growth prospects are weak, but it remains a global player due to its innovation and strong governance. Countries like Germany and France still dominate in industries like renewable energy, aerospace, and luxury goods. However, Europe’s aging population and political fragmentation pose long-term challenges.

Emerging Powers: Brazil, Turkey, and Indonesia

These countries are on the rise, but they face significant internal challenges. Brazil struggles with inequality, Turkey with political instability, and Indonesia with corruption. However, these nations offer high potential for those willing to take on the risk.

10 Key Takeaways from Ray Dalio’s Global Power Index

To make sense of the overwhelming data in Dalio’s Index, here are ten key takeaways you should know—and why they matter to you:

1. Internal Disorder Is the Greatest Short-Term Risk

According to Dalio, internal disorder—particularly in countries like the U.S.—poses the biggest short-term threat to global stability. Rising inequality, political polarization, and social unrest are destabilizing forces that could lead to economic shocks. The U.S. is seeing its highest levels of internal conflict since the 1960s, and this could have major implications for everything from stock market volatility to foreign investment.

2. The U.S.-China Conflict Will Shape the Future

The power struggle between the U.S. and China isn’t just a geopolitical issue—it’s an economic and technological one too. The two countries are locked in a race to dominate sectors like AI, semiconductors, and renewable energy. As tensions escalate, global supply chains will be disrupted, and businesses that rely on either market will have to adapt. For investors, this rivalry is critical to watch.

3. India’s Unmatched Growth Prospects

India’s growth story is unprecedented. With a projected growth rate of over 6%, it’s the fastest-growing economy in Dalio’s Index. But there’s a caveat: India ranks last in happiness and near the bottom in health. Despite its booming economy, the quality of life for many Indians remains low. This imbalance could lead to social instability in the future, making India both an opportunity and a risk for long-term investors.

4. The Eurozone is Struggling, But Not Out

Europe’s growth outlook is bleak. The Eurozone is projected to grow by just 0.2% over the next decade, with countries like Germany and Italy facing economic stagnation. But Europe still has significant strengths, particularly in industries like luxury goods, aerospace, and renewable energy. For investors, it might not be a high-growth market, but it’s still a safe bet for long-term stability.

5. Massive Debt Levels Pose a Global Threat

One of the most worrying trends in Dalio’s Index is the massive debt levels in countries like the U.S., Japan, and the Eurozone. With government debt levels reaching all-time highs, the risk of a debt crisis is growing. Central banks have been buying up debt to prevent economic collapse, but this isn’t sustainable. For investors, rising debt levels could lead to inflation, currency devaluation, and market volatility.

6. Innovation and Technology Will Define Future Power

Countries that lead in technology and innovation will dominate the global landscape. The U.S. and China are ahead in this race, particularly in fields like artificial intelligence, biotechnology, and clean energy. South Korea and Japan also rank high in innovation, and their focus on tech will keep them relevant. For individuals, investing in companies that prioritize innovation will likely yield long-term returns.

7. Health and Happiness Don’t Always Track With Growth

Economic growth doesn’t always mean a happier or healthier population. Dalio’s Index shows that countries like India and China are growing rapidly, but they rank poorly in health and happiness. Meanwhile, countries like the Netherlands, Switzerland, and Singapore score much higher in these areas. This imbalance suggests that focusing solely on GDP growth can obscure deeper issues of well-being.

8. Military Strength Isn’t Enough to Guarantee Global Power

While military strength is still important, it’s no longer the sole determinant of global power. The U.S. has the world’s strongest military, but Dalio points out that economic and technological factors are becoming equally important. For example, China’s military is still weaker than the U.S., but its economic clout gives it leverage on the global stage. For those thinking about long-term investments, military power should be considered alongside economic stability and innovation.

9. Climate Change and Natural Disasters Are Changing the Game

Dalio’s Index highlights the increasing frequency and impact of natural disasters and climate change. Countries that are more resilient to environmental risks—like Singapore and Switzerland—are better positioned for long-term stability. Meanwhile, nations vulnerable to climate shocks, such as those in Southeast Asia, may face greater challenges.

10. Global Conflict is Intensifying

The world is seeing an uptick in global conflict, with tensions rising in places like Ukraine, the South China Sea, and the Middle East. Dalio’s global conflict gauge is at levels not seen since the Cold War, and this instability will have ripple effects on trade, investment, and global security.

The Future is Uncertain, But BRICS Is Reshaping Global Dynamics

Ray Dalio’s Global Power Index offers a comprehensive view of the changing world order, but the implications are even broader when we factor in the rising influence of BRICS nations. As Dalio's report shows, countries like China and India are already growing at impressive rates, and their role in reshaping global trade is undeniable. But there’s more at play here than just economic growth. The BRICS alliance is beginning to shift the global financial system itself, potentially reducing the dominance of the U.S. dollar in global trade.

The Shift Away From the U.S. Dollar

For decades, the U.S. dollar has been the world’s primary reserve currency, which has given the U.S. significant leverage in global finance and trade. However, as BRICS countries expand their economic influence, there’s increasing discussion about creating a new currency or system of trade that’s not reliant on the dollar. If BRICS succeeds in reducing global dependency on the U.S. dollar, it could mark a fundamental shift in global trade dynamics.

The implications of this shift could be enormous. For one, it would challenge the financial dominance of the U.S., potentially reducing the economic advantages the U.S. has enjoyed for decades. Countries like China, with its growing influence in global trade, and India, with its rapid economic growth, are in a position to lead this transition.

BRICS as a Counterbalance to Western Dominance

BRICS isn’t just an economic alliance—it’s a geopolitical one. As Dalio’s Index points out, global conflict is intensifying, and much of it revolves around power struggles between Western nations (led by the U.S.) and emerging economies like those in BRICS. The more BRICS nations cooperate in areas like energy, infrastructure, and trade, the more they can act as a counterbalance to Western influence.

But there’s still a lot of uncertainty here. While BRICS has the potential to reshape global economics, there are internal challenges that could hold it back. For instance, Russia’s political instability and Brazil’s economic struggles are real risks to the unity and strength of BRICS. Yet, if these countries can overcome their internal issues, BRICS could very well lead a new era of global trade.

What This Means for You

If you’re an investor or someone thinking about where the global economy is heading, this shift from a U.S.-centric world to a more multipolar one is crucial to understand. The dominance of the U.S. dollar has made American markets the default safe haven for investors, but as BRICS grows in influence, that may change. It could create new opportunities in emerging markets but also introduce new risks as the global financial system becomes more fragmented.

Ray Dalio’s analysis provides a clear framework for understanding these shifts, but it’s up to us to interpret what comes next. As the world becomes more interconnected, paying attention to these global trends will be key to navigating an uncertain future.

Comments

Post a Comment