세레브라스, 엔비디아보다 20배 빠르고 100배 저렴한 새 AI 추론 서비스 출시; 아부다비의 투자를 받고, 시티그룹의 도움으로 IPO 준비 중

https://www.aitimes.com/news/articleView.html?idxno=162905

세레브라스, 새 AI 추론 서비스 출시..."엔비디아보다 20배 빠르고 100배 저렴"

인공지능(AI) 반도체 스타트업 세레브라스가 세계에서 가장 빠르고 저렴한 AI 추론 서비스를 출시했다. '챗GPT'와 같은 생성 AI 애플리케이션이 대중화되며 AI 추론과 관련한 수요가 기하급수적으로 증가할 것으로 판단, 자신들의 장점을 내세워 엔비디아에 도전장을 내민 것이다.

로이터는 27일(현지시간) 세레브라스가 엔비디아보다 최대 20배 빠른 AI 추론 서비스 '세레브라스 인퍼런스(Cerebras Inference)'를 출시했다고 보도했다.

AI 추론(인퍼런스)은 이미 훈련된 AI 모델을 작동해 챗봇의 답변과 다양한 작업 해결 등의 출력을 얻는 프로세스다.

세레브라스는 “추론은 클라우드 컴퓨팅에서 전체 AI 관련 워크로드의 40%를 차지하는 등 AI 업계에서 가장 빠르게 성장하는 부문”이라며 “고속 추론 서비스가 AI 산업의 전환점이 될 것”이라고 말했다.

세레브라스 인퍼런스는 대형언어모델(LLM) '라마 3.1 8B'에서 초당 1800 토큰, '라마 3.1 70B'에서 초당 450 토큰을 처리한다. 이는 마이크로소프트(MS) 애저를 포함한 하이퍼스케일 클라우드에서 제공되는 엔비디아 GPU 기반 AI 추론 서비스보다 약 20배 빠른 속도다.

획기적인 성능 향상뿐만 아니라, 가격 경쟁력도 갖췄다. 예를 들어 100만 토큰 당 고작 10센트의 가격으로 이용할 수 있어, 기존 GPU 클라우드 대비 최대 100배 높은 가격 대비 성능을 제공한다.

세레브라스는 20배 빠른 추론 속도를 통해 AI 앱 개발자가 정확도나 비용 손실 없이 차세대 AI 애플리케이션을 구축할 수 있다고 설명했다.

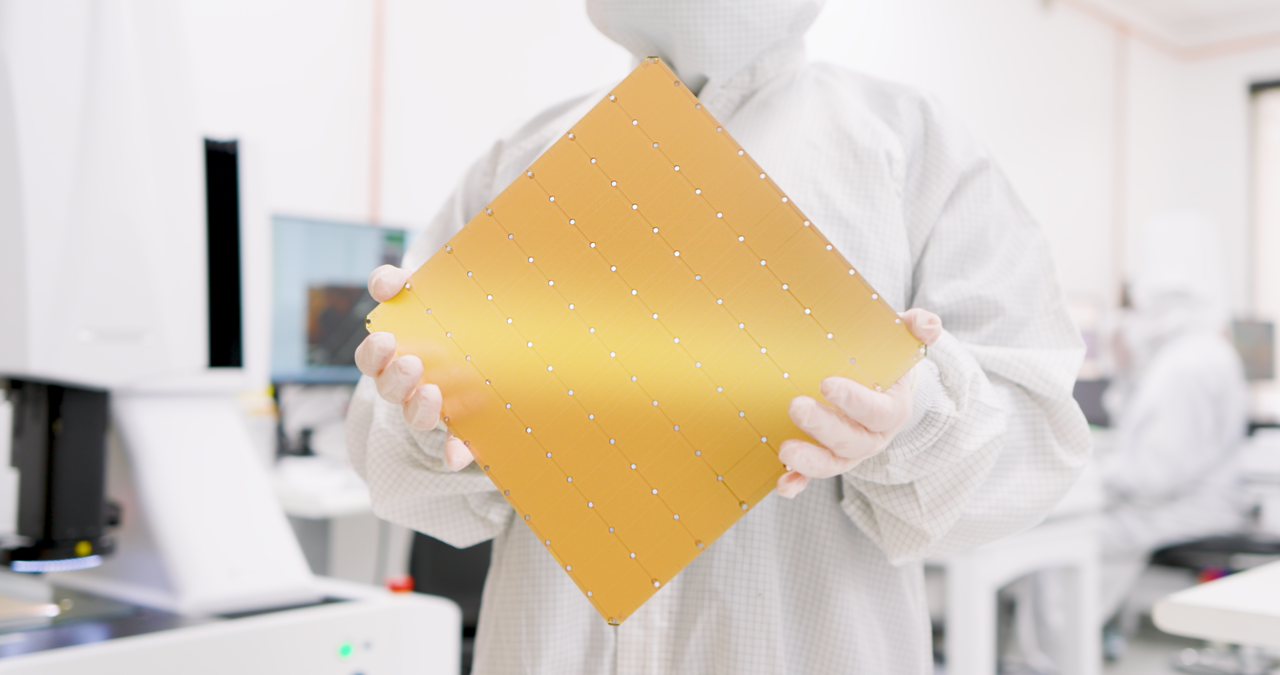

이 혁신적인 가성비는 세레브라스 'CS-3' 시스템과 웨이퍼 스케일 엔진 3(WSE-3) AI 프로세서를 통해 가능했다. 접시만큼 큰 세레브라스의 WSE-3 칩은 초당 1000개의 토큰을 처리할 수 있는데, 이는 광대역 인터넷과 맞먹는 수준이다. 앤드류 펠드만 세레브라스 CEO는 "WSE-3 칩은 엔비디아 GPU보다 훨씬 나은 성능을 제공한다"라고 주장했다.

특히 CS-3는 엔비디아 'H100'보다 메모리 대역폭이 7000배 넓어 생성 AI의 메모리 대역폭 문제를 해결했다.

세레브라스 인퍼런스는 무료 티어, 개발자 티어, 엔터프라이즈 티어 등 세가지 형태로 제공된다.

무료 티어는 로그인하는 모든 사용자에게 무료 API 액세스와 충분한 사용량 제한을 제공한다. 개발자 티어는 유연한 서버리스 배포를 위해 설계됐으며, 라마 3.1 8B 및 70B 모델의 경우 100만 토큰 당 각각 10센트, 60센트의 가격으로 API 엔드포인트를 제공한다. 엔터프라이즈 티어는 미세조정된 모델, 맞춤형 서비스 수준 계약(SLA), 전담 지원을 제공한다.

세레브라스는 클라우드를 통해 여러 유형의 추론 서비스를 제공하지만, 자체 데이터 센터를 운영하는 것을 선호하는 기업에게는 AI 시스템을 판매할 계획이다.

현재 AI 시장은 엔비디아가 장악하고 있지만, 세레브라스와 그로크 같은 기업들의 등장은 업계 역학 변화를 예고한다. 특히 더 빠르고 비용 효율적인 AI 추론 서비스에 대한 수요가 증가하는 추세다.

https://cerebras.ai/

https://www.fool.com/investing/how-to-invest/stocks/how-to-invest-in-cerebras-stock/

Proclaiming itself the "pioneer" in generative artificial intelligence (AI), Cerebras and its stock have drawn increasing attention from AI investors, engineers, and aficionados. In March 2024, Cerebras introduced the Third Generation 5nm Wafer Scale Engine, or WSE-3, which the company claims is the fastest AI chip. It's no wonder Cerebras is garnering considerable interest from the AI community.

Artificial Intelligence

With Open AI's launch of ChatGPT in late 2022, generative AI exploded onto the scene. Now, it and other generative AI models are becoming increasingly present in our daily lives. It's hardly expected to slow down. According to Bloomberg Intelligence, the generative AI market is projected to grow from about $40 billion in 2022 to over $1.3 trillion in 2032 -- a compound annual growth rate (CAGR) of almost 42%.

In addition to several government laboratories, Cerebras has a variety of customers operating in the private sector. The Mayo Clinic, for example, has turned to Cerebras for assistance in developing AI models for healthcare.

Financial details of the relationship are scarce, but Cerebras CEO Andrew Feldman identified the deal as a "multi-million-dollar" arrangement. Oil supermajor TotalEnergies (TTE 0.47%) has also enlisted Cerebras to help with seismic modeling.

While investors may be motivated to add Cerebras to their portfolios, there are important things to take into account. Besides looking at how to buy shares of Cerebras stock, investors will want to consider when the company plans to hold its initial public offering (IPO) and whether alternative investment opportunities exist.

IPO

Is Cerebras publicly traded?

Cerebras has held several funding rounds that have helped it to raise capital from investors like the Abu Dhabi Growth Fund and venture firm Benchmark Capital. After completing a Series F round in 2021, Cerebras had raised about $715 million in funding, according to Crunchbase.

Most individual investors, however, don't have the same opportunity to gain Cerebras exposure. As of April 2024, Cerebras was not a publicly traded company.

When will Cerebras IPO?

Although 2023 saw a slowdown in the number of companies holding IPOs compared to previous years, some pundits predict an increase in IPO activity during 2024. While Cerebras is not officially on the calendar to hold an IPO, there is speculation that the company is looking to debut on the public markets in 2024.

According to reporting from Bloomberg News, Cerebras has chosen Citigroup (C 0.59%) to help it with the IPO, which the company may pursue as soon as the second half of 2024. So, investors may soon have the opportunity to click the buy button on this IPO stock. Consistent with its latest round in 2021, Cerebras may seek a valuation in excess of $4 billion.

How to buy Cerebras stock

For most investors, picking up shares of Cerebras is not possible. People who qualify as accredited investors, on the other hand, may be able to buy Cerebras stock before its IPO. Some platforms, like Forge Global (FRGE 5.97%), allow accredited investors to buy shares of pre-IPO companies like Cerebras.

While people who don't qualify as accredited investors may be unable to buy Cerebras stock, that doesn't mean they're completely out of luck. There are a variety of other AI stocks for them to consider. Here's a four-step guide on how to buy stocks.

Step 1: Open a brokerage account

Buying stocks is a great step toward building personal wealth. To get started, investors must open a brokerage account. Many options are available, but inexperienced investors may want to consider Fidelity, which offers zero-commission online trades.

Step 2: Figure out your budget

People with substantial experience know that creating a budget is integral to successful investing. Maybe you have an ample pile of cash to begin investing. Maybe you plan to start with just a few bucks. Whatever the case, it's critical to assess your financial situation and determine an appropriate budget.

Step 3: Research related companies

While the average investor waits for Cerebras to hold its IPO and become an option for them, there are several other stocks they may find worthy of buying now.

1. Nvidia

One of the most obvious alternatives for prospective Cerebras investors is AI stalwart Nvidia (NVDA -0.03%), arguably Cerebras' most formidable competitor. With its Hopper Tensor Core GPU (graphic processing units), Nvidia was already an industry leader in supporting AI computing.

However, Nvidia upped its AI game in March 2024 with its X800 series network switches. The company characterizes the X800 switches as "end-to-end networking platforms that enable us to achieve trillion-parameter-scale generative AI essential for new AI infrastructures."

Despite its commanding position -- the company's market capitalization exceeded $2.2 trillion in April 2024 -- there's still a general consensus among investors that Nvidia has plenty of opportunities for growth ahead of it. That's something that likely appeals to investors also interested in Cerebras.

Market Capitalization

And since it generates massive amounts of cash, it represents an AI investment opportunity at the lower end of the risk spectrum. In fiscal year 2024, for instance, Nvidia reported free cash flow of $26.9 billion.

2. Qualcomm

Instead of a competitor, investors may feel more compelled to pick up shares of a collaborator. Qualcomm (QCOM 1.67%), for example, has partnered with Cerebras, making a way for investors to indirectly gain exposure to the privately held company.

In March 2024, Cerebras announced it had selected Qualcomm's Cloud AI 100 Ultra, an AI inference card designed specifically for generative AI and large language models, to be used with its CS-3 AI accelerators for training to provide a superior AI solution.

To simply brand Qualcomm an AI company would be giving it short shrift. As a leading semiconductor company, Qualcomm provides wireless solutions found in numerous applications, including smartphones, vehicles, and devices operating on the Internet of Things.

The company has a variety of available growth opportunities. While investors wait for these to play out, they can reap the rewards of the company's dividend, which had a forward yield of 1.9% as of April 2024.

3. Astera Labs

Instead of waiting for Cerebras to hold its IPO, investors can opt for an AI-oriented semiconductor stock that recently held its IPO -- a stock like Astera Labs. Making its way to publicly traded markets in March 2024, Astera Labs offers its Intelligent Connectivity Platform to meet the connectivity demands of AI and cloud infrastructures. Already, the company has secured some industry leaders as customers.

Raghu Nambiar, Advanced Micro Devices' (AMD 1.02%) vice president for data center ecosystems and solutions, said: "Close collaboration with Astera Labs on PCIe technologies [connections for high-bandwidth communication] ensures our customers' platforms continue to meet the higher bandwidth connectivity requirements of next-generation AI and HPC [high-performance computing] workloads." Intel (NASDAQ:INTL) and Nvidia also use solutions from Astera Labs.

The company posted revenue of $115.8 million and a net loss of $26.3 million in 2023.

Step 4: Place an order

You're almost at the finish line -- just some final decisions to make. For one, you'll have to decide how many shares you'd like to buy. Next, you'll have to choose the type of order you want to make: a market order or a limit order. Finally, click the buy button and celebrate the step you've just taken toward building your personal wealth.

Is Cerebras profitable?

As a privately held company, Cerebras isn't subject to the same requirements as publicly traded companies, which are required to submit regulatory filings. Given the sparse information available about Cerebras' finances, it's difficult to determine whether the company is generating a profit.

If the company launches an IPO, investors will gain much greater insight into the company's financial health when they get to dig through the company's prospectus, also known as an S-1.

Should I invest in Cerebras?

Cerebras is a privately held company, so it is not an investing option for most people. If the speculation surrounding its 2024 IPO rings true and the stock becomes available for retail investors, Cerebras will have to submit regulatory filings, giving investors a peak at its financials. At that point, it will be easier to assess the company's financial health and determine whether the stock is a good fit.

Accredited investors may be able to gain exposure to Cerebras currently. But even for them, a position in Cerebras carries a fair degree of risk, so they must be comfortable with a more speculative investment.

ETFs with exposure to Cerebras

Cerebras isn't publicly traded, so investors can't gain exposure to the company through an exchange-traded fund (ETF). But other options exist. There are several artificial intelligence (AI) ETFs that may interest investors.

- Vanguard Information Technology ETF (VGT 0.59%): Don't let the name fool you. Though AI isn't specified in the ETF's name, the fund has plenty of AI exposure. Nvidia is the ETF's third-largest holding; Broadcom (AVGO 1.9%) and Advanced Micro Devices are the second- and third-largest holdings, respectively. The ETF has a low expense ratio of 0.1% and makes quarterly distributions.

- Roundhill Generative AI & Technology ETF (CHAT 0.22%): Branding itself the "world's first Generative AI ETF," this ETF may be an ideal option for investors frustrated that they can't buy Cerebras stock. After Nvidia, the ETF's largest holding, OpenAI partner Microsoft (MSFT 0.84%) represents the ETF's next-largest position. Combined, Nvidia and Microsoft account for more than 15% of the ETF's portfolio, which has 43 holdings and a 0.75% expense ratio.

- Global X Artificial Intelligence & Technology ETF (AIQ 0.23%): With 84 holdings in its portfolio, this ETF provides a broader approach to AI. In addition to holding companies that produce hardware catering to AI, the ETF aims to invest in "companies that potentially stand to benefit from the further development and utilization of artificial intelligence (AI) technology in their products and services." Besides top holdings Nvidia, Broadcom, and Qualcomm, the ETF includes Meta Platforms (META -0.19%), Netflix (NFLX 1.49%), and Amazon (AMZN -0.27%) in its top holdings, with a 0.68% total expense ratio.

Related investing topics

The bottom line on Cerebras

In light of the massive growth that the generative AI market is expected to experience over the next decade, it's unsurprising that investors have Cerebras on their radar. While the company has achieved noteworthy success, it's unclear how this success has translated to the company's financial health -- something investors will have a better sense of if the company proceeds with its plans to hold an IPO. In the meantime, investors have a variety of other AI stocks and ETFs they can consider.

Should you invest $1,000 in Citigroup right now?

Before you buy stock in Citigroup, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Citigroup wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Comments

Post a Comment