[다큐] 일본 '잃어버린 20년'의 전개 과정: 지나치게 급격한 부동산 버블의 붕괴가 장기 디플레이션의 원인, 일본인들이 1993년부터 피부로 느끼게 된 버블폭락과 고용한파, 1995년 고베 대지진과 일본 중앙은행의 금리 인하 (2.5%->0.5%), 일본 정부의 자민당 유착 부실기업 (95년 Jusen, 98년 LTCB)에 대한 공적자금 투입, 노지마 신지의 어두운 사회파 드라마의 인기, 1996년 일드 롱베케이션의 분위기, 1995년 역플라자합의와 1997년 IMF 외환위기, 하시모토 내각의 소비세 3%->5% 인상/의료보험비 10%에서 20% 인상의 후폭풍, 1990년대에 20대였던 '잃어버린 세대'가 소비를 못하게 되면서 경제성장도 주춤

일본 버블폭락의 시점을 1991년이 아닌 1993년으로 잡은 것부터가 예리하다!

00:00 - Intro - The Story of Japan's Lost Decade 01:20 - Part 1: 1991-1994 03:16 - The Japanese bubble-burst through the eyes of Katsuhide Kageyama 07:34 - The Japanese government steps in 12:07 - Part 2: 1995-1997 - Everything gets even worse... 15:00 - The Kobe earthquake and the yen appreciation 19:54 - Part 3: 1997-1999 - Reality catches up to the Japanese government 26:21 - Part 4: 1999-2001 - The "end" of the lost decade 28:20 - Outro

https://www.konichivalue.com/p/japans-bubble-burst-the-party-that

To fully understand the greatest economic collapse in history, the collapse of the Japanese Economic Bubble, I relied on several sources.

Primarily, I used excerpts from Katsuhide Kageyama's book "Redoing Economic History" (2014) and restructured them, adding in parts from the book "Princes of the Yen" by Richard Werner (2003). I also included multiple reputable sources such as Deutsche Welle and Nikkei Asia.

This was the most thorough project I have ever undertaken, and I am thrilled to have finally finished it. So, without further ado, enjoy!

The Story of Japan’s Lost Decade

Table of contents:

1991-1994: The party that wasn’t supposed to end

1995-1997: Everything gets even worse…

1997-1999: Reality catches up to the Japanese government

1999-2001: The “end” of the lost decade

1991-1994: The party that wasn’t supposed to end

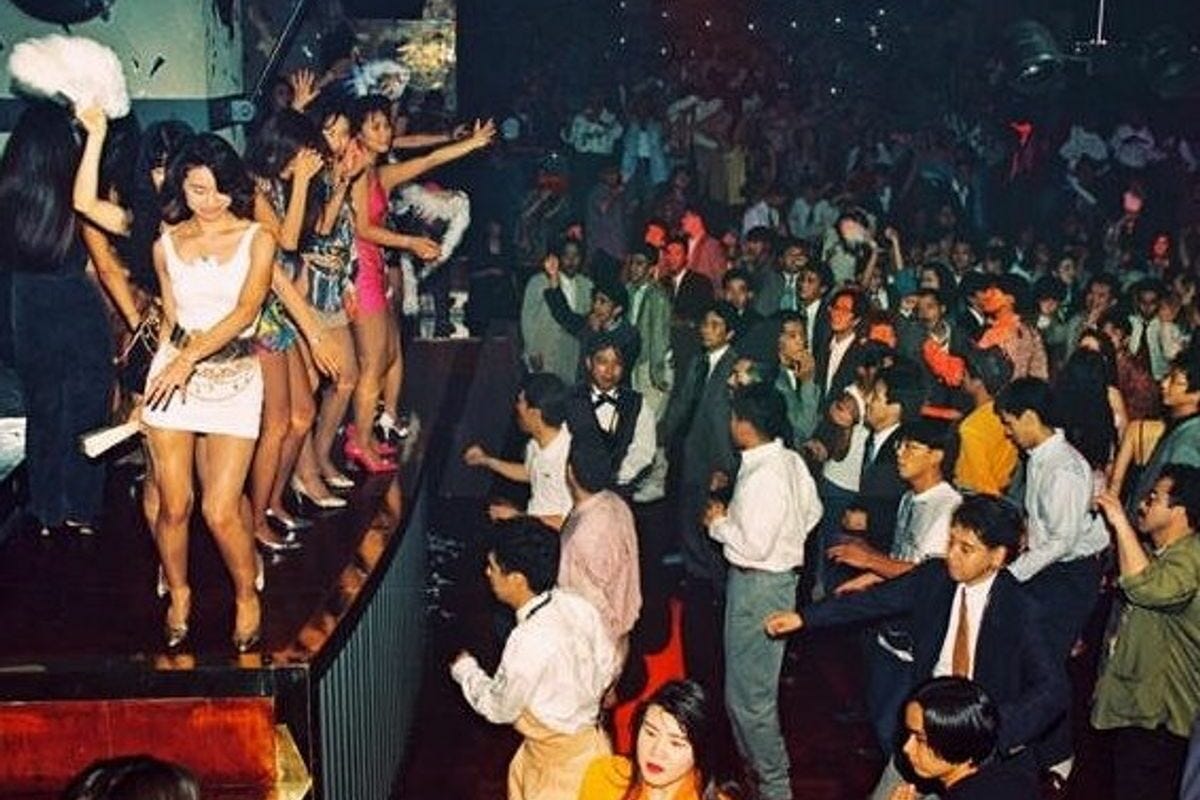

Some Japanese City-pop to get you in the mood of peak-bubble Japan:

Japan was on the verge of surpassing the United States as the world's largest economy, basking in the glow of seemingly endless prosperity...

Then, the party suddenly stopped…

The Japanese economic bubble burst in 1991, as the decline in land prices began that year. In fact, Japanese stock prices started falling at an alarming rate at the end of 1989.

However, it wasn't until 1993 that most Japanese people realized that the economy was in deep trouble.

An important lesson for future recessions is that there is often a gap between the decline in the economy and the realization of a recession. Just because real estate and stocks are not doing well does not mean that companies will instantly fail. Even if they can't borrow money from big banks, they may still be able to secure capital from investors and less risk-averse banks.

However, as the economic situation gradually becomes worse, profits decline, and sources of money start shriveling up...

The Japanese bubble-burst through the eyes of professor Katsuhide Kageyama:

This part is a collection of translated excerpts from the book “Redoing Economic History” (Kageyama, 2014).

In the early 90s, I was a carefree student living the dream!

I spent every single day indulging in every vice imaginable - drinking, women, gambling, and pouring my money into every investment opportunity that crossed my path.

Everything was on the rise, and it felt like every yen I spent would magically double in value overnight. The bubble of the past few years had completely distorted our perceptions, filling us all with an irrational sense of hope and optimism. We never stopped to consider the possibility that our good fortune might come crashing down.

That's why I, and everyone around me, made the most reckless risk judgments imaginable. I thought, 'If stock prices have fallen, who cares? I'll just buy some land and recoup the losses.' It was like a compulsive gambler thinking, 'I lost at Pachinko, no problem, I'll just win it all back with Mahjong.' But the difference was that an entire nation was thinking this way!

This idea is perfectly captured in Kaiji, the Japanese manga about the minds of obsessive gamblers, which the Netflix series Squid Games is based on.

Getting a job went from a given to a luxury

Around 1993, we were keenly aware of the arrival of a full-scale recession due to physical signs of the bursting of all assets in the Japanese economy.

That was the year I graduated and started job-hunting.

I had always complained about not wanting to be a corporate employee, but it was time to grow up and contribute to society... or so I thought.

I eagerly waited for the job postings to come flooding in, like they had every year before.

But they never arrived. Had I missed some memo about a new way of recruiting?

Despite my unease, I went to the nearest bookstore and bought a job information magazine. I sent my resume to three companies that I thought would offer me a job within days. But then, I received replies from all three companies.

When I saw them, I couldn't believe my eyes! Although they were worded differently, they all had the same message: 'Due to various circumstances, we have decided not to hire new graduates this year.' What did they mean?

The bubble had already burst, and the newspapers and TV had been saying it for a long time, but this was the first time I really felt it.

That year, I failed to find a job and became a freelance lecturer at a cram school. I remember feeling so humiliated... My whole life, I had been taught that full-time corporate employment was the only respectable occupation, and anything less was only for good-for-nothing deadbeats.

For the first time, the world around me was flooded with news of bankruptcies, arrests of CEOs, bankers, politicians, and scandals at securities companies. Maybe Japan wasn't as amazing as we had believed?

To add insult to injury, there was an unprecedented rice shortage that year, and most Japanese people were forced to eat Thai rice, which was considered vastly inferior to Japanese rice.

What a humbling year it was...

End of passage

The Japanese government steps in

Shortly after the burst of the bubble, the Japanese government announced that it will implement "emergency economic measures".

They offered the most orthodox fiscal policy possible: Issuing new government bonds and using them as financial resources to reduce income taxes and carry out public works projects.

If it was a normal recession, this policy would have gradually recovered the economy.

However, this was no ordinary recession; this was the biggest bubble in history that had just collapsed!

To address the root cause of the bubble, not only was it necessary to create demand through stimulus, but also to clean up Japan's financial sector.

While the government was able to spur consumption to some extent by scattering money, the banks and securities companies were not functioning properly, causing the flow of money to simply form new bubbles.

After some time of ever-increasing government stimulus, nothing had really changed. All that was left for the people was a recession with no end in sight and a massive financial deficit due to the issuance of deficit-covering government bonds

Japanese banks had billions in collateral, but why was it not collected?

As Japan's economic bubble burst, one of the biggest roadblocks to recovery was the staggering amount of non-performing loans held by Japanese banks.

These loans had become uncollectible, with the lenders essentially bankrupt and in the process of legally liquidating their assets.

But here's the twist: when the banks went to collect, they found that many of the insolvent companies had few assets left to seize.

This was because, in the frenzied lead-up to the bubble, banks had recklessly lent more money than the current collateral value of the borrower, and brokers had often worked with bankers to fabricate fake requests for approval. So when the bubble burst and the banks tried to recoup their losses, they were left with a mountain of low-value junk real estate instead of the cash they were owed. And to make matters worse, the value of that real estate was plummeting as the bubble burst.

Despite this, many bankers chose to sweep the problem under the rug, keeping the loans at their inflated value on the balance sheets even as the bubble burst.

Why? Because many of the bankers personally held these high-risk loans from the bubble period and acknowledging the bad loans would not only sink the bank, but also bankrupt all its employees.

As the bubble burst grew larger, the true state of the banks was exposed, and bad loans skyrocketed at an alarming rate.

In other words, on paper, Japanese banks had massive collateral, but in reality, it was nothing more than junk.

As a result, the banks were forced to write off the bad loans and endure massive losses, setting off a vicious cycle where their capital base was decimated and they were unable to lend, only exacerbating Japan's economic decline.

1995-1997: Everything gets even worse…

The government started bailing out banks with tax-money

In 1995, Jusen, a group of Japan's largest financial institutions focused on residential mortgages, went bankrupt. Despite being backed by the trusted agricultural cooperatives (JA), Jusen was thought to have no financial issues until the bubble burst.

However, in a surprising move, the government decided to pour 685 billion yen of public tax funds into the already bankrupt Jusen, inciting a fierce backlash from the public

The bailout of Jusen was shrouded in suspicion from the start.

For one thing, six out of eight of Jusen's presidents were former bureaucrats from the Ministry of Finance, raising eyebrows about the government's involvement.

But that was just the tip of the iceberg. The Ministry of Finance, which was supposed to publicly report the total volume of real estate loans, conveniently created an exception for loans to residential housing and agricultural cooperative financial institutions - which just so happened to be Jusen's main holdings. And if that wasn't enough, the Ministry of Finance and the Ministry of Agriculture, Forestry, and Fisheries (MAFF) secretly struck a deal to bail out JA in the event of bankruptcy in exchange for investing in Jusen (this dirty secret was later exposed in the 1996 Jusen Diet).

Essentially, Jusen was a puppet of the bureaucrats at the Ministry of Finance, serving their own interests, and its assets were tied to MAFF, JA, and the ruling Liberal Democratic Party (LDP). Despite widespread public outrage at the idea of bailing out Jusen with taxpayer money, the government saw it as a necessary evil, setting a dangerous precedent for bailing out financial institutions with public funds in Japan.

The tragic Kobe Earthquake: The unforeseen catalyst for the rapid rise of the Yen

On January 17, 1995, Japan was hit by the Great Hanshin-Awaji Earthquake, or Kobe earthquake. It lasted for over 20 seconds and was among the strongest, deadliest, and costliest to ever strike the country. It measured 7 on the JMA Seismic Intensity Scale and killed 6,434 people. The earthquake left over 300,000 people homeless, destroyed over 200,000 buildings, and caused extensive damage to infrastructure and industry.

The damage was estimated to be over $100 billion, making it one of the most expensive natural disasters in history.

As the devastating effects of the earthquake wreaked havoc on the country, Japanese insurance companies were hit with a deluge of insurance claims. In a frenzied effort to prepare for the financial aftermath, they frantically sold off their foreign currency assets and rushed to buy yen.

To make matters worse, domestic consumption of foreign goods and services plummeted while demand for Japanese products abroad remained high, causing foreigners to flock to the yen to buy Japanese goods.

But that's not all - a host of other factors contributed to the yen's rapid appreciation, including measures taken by the United States to reduce the trade deficit with Japan, the devaluation of the yuan as a preferential treatment for China, the evacuation of foreign money to the yen due to the Mexican currency crisis, and speculative purchases of the yen.

The yen-appreciation progressed at a rapid pace: In 1990, the yen began to appreciate to around 150 yen to the dollar, but by early 1995 it was 100 yen to the dollar, and then 90 yen and then 80 yen.

On April 19, 1995, the exchange rate finally reached its peak of 79 yen to the dollar.

The Bank of Japan steps in to save the day

As Japan teetered on the brink of economic disaster, many saw the writing on the wall: if the yen continued to appreciate, Japanese exports would become unprofitable, leading to more bankruptcies.

In a desperate move to stop the appreciation, the Bank of Japan (BOJ) slashed its official interest rate to an all-time low of 0.5%.

Sound familiar? It should - this was the same move that set off the Japanese financial bubble in 1986, when the BOJ lowered the interest rate to 2.5%. As banks rushed to borrow and lend at a dizzying pace, claiming it was too cheap to ignore, a massive bubble formed. So, with the post-bubble rate now only one-fifth of that, could another huge bubble be in the making? Absolutely not.

Scars from the burst bubble were still fresh, and Japanese banks were turning away incoming customers in a panic, viewing them as potential sources of bad debt. Instead of lending, they focused on preventing any further risk, even if it meant zero growth. They even went so far as to deny small and medium-sized enterprises working capital on the grounds of broken collateral, effectively sentencing them to death.

As the saying went, 'Banks lend umbrellas when it's sunny, and take them away when it rains', perfectly capturing the desperate state of the Japanese banks at the time.

1997-1999: Reality catches up to the Japanese government

The fiscal law that destroyed Japan’s recovery

In 1997, as the Japanese economy continued to struggle in the midst of the post-bubble recession, the government made a shocking move. Despite the already difficult economic situation, they implemented the Fiscal Structural Reform Law, a policy that essentially said "we know we're in a recession, but we're going to take even more of your money."

Desperate to restore financial stability and reduce debt, the ruling Hashimoto Cabinet raised the consumption tax from 3% to 5%, increased medical expenses for salaried workers from 10% to 20% (which today, are a staggering 30%), and canceled all special income tax cuts. Despite these measures, the budget deficit still increased by a trillion yen that year.

But things were about to get even worse. At the end of 1997, the Asian Currency Crisis hit, causing loans all over Asia to become non-performing. This sent the Japanese economy spiraling into an even deeper recession and led to widespread public discontent, ultimately resulting in the defeat of the Hashimoto Cabinet in the 1998 House of Councilors election.

The fall of Japanese banks: Pessimism reigns as bad institutions finally collapse

The chain reaction of bankruptcies began in November 1997 with the fall of Hokkaido Takushoku Bank (Takugin), Hokkaido's largest bank. While this may have been shocking at the start of the bubble burst, the Japanese public had become accustomed to expecting the worst and pessimism had become the norm.

Just one week later, Yamaichi Securities, one of Japan's four main securities firms, shut down voluntarily. This sent shockwaves throughout the industry, as Yamaichi was considered one of the biggest and most respected companies in the field, alongside Nomura, Daiwa, and Nikko.

The LTCB bankruptcy: A catalyst for exposing corruption in the Japanese government

In 1998, the mighty Long-Term Credit Bank of Japan (LTCB) went bankrupt, bringing down with it a legacy that had spanned nearly half a century.

Founded in 1952, LTCB was the largest long-term credit bank in Japan and, at its peak, the ninth largest bank in the world. Its mission was to fund capital investment for post-war reconstruction efforts, but as the number of customers dwindled during the bubble period, the bank made risky bets on land and stocks in a desperate bid to secure new business.

Tragically, these gambles backfired and LTCB found itself unable to repay its loans to insolvent customers and leasing companies. And yet, even as the bank teetered on the brink of collapse, it remained stubbornly alive, as if on life support. Who was keeping LTCB afloat?

Who was keeping LTCB alive?

The answer lay in the bank's deep connections to the conservative faction of Japan's ruling Liberal Democratic Party (LDP), known as the Koikekai. LTCB had been founded by Hayato Ikeda, a former prime minister of Japan, and acted as the Koikekai's personal piggy bank. As a major lender to general contractors, LTCB was vital to the LDP, which relied on these contractors for both votes and donations.

The LDP was determined to protect LTCB at all costs, even as top executives at the bank were arrested for fraudulent accounting and fraud (although they were ultimately acquitted by the Supreme Court). Keizō Obuchi, the prime minister at the time of LTCB's bankruptcy, even tried personally to find a buyer for the troubled bank. When those efforts failed, Kiichi Miyazawa, chairman of the Financial Reconstruction Commission, stepped in with a plan to keep LTCB alive until a receiver could be found. In the end, even this was not enough, and two long-term bank executives involved in the cover-up were driven to suicide.

1999-2001: The “end” of the lost decade

After a decade of economic crisis and the downfall of some of Japan's most corrupt institutions, the nation's economy finally began to emerge from the ashes, growing steadily if modestly. Amidst numerous cabinet reshuffles and revelations of corruption, structural reforms such as deregulation and liberalization were finally implemented, helping to bolster the efficiency and competitiveness of the Japanese economy.

But Japan's recovery was not solely a result of its own efforts. The recovery of major economies like the United States and China also played a crucial role, driving demand for Japanese exports and improving global economic conditions.

Despite these hopeful signs, Japan's recovery was far from complete. The nation faced a daunting challenge in the form of a declining population and aging society, leading to a shortage of labor and a reduction in domestic demand. Japanese banks remained hesitant to lend to anyone but large enterprises, and Japanese companies resisted implementing new reforms and technologies. In fact, Japan currently ranks as the least productive country among the G7 nations.

Despite the implementation of structural reforms and expansionary monetary and fiscal policies, there are still concerns about the underlying health of Japan's economy and its ability to sustain long-term growth. The end of the lost decade may bring some relief, but it is clear that Japan still has a long road ahead to secure a bright and prosperous future.

As the nation looks towards the future, it is left to wonder what could have been if not for the devastating events of the lost decade.

Thank you Victor for the idea for this article

플라자 합의 후 10년이 지난 1995년 4월 18일, 도쿄 외환시장에서 엔-달러 환율 80엔이 붕괴되자 다음 달 세계경제 안정을 위해 선진 7개국(G7)이 달러가치 부양을 목적으로 합의를 한 것이 바로 '역플라자 합의'인데요. 역플라자 합의에 의해 엔-달러 환율이 148엔대까지 오르면서 엔고 문제가 해결되었습니다.

그럼, 역플라자 합의는 왜?라는 질문이 나오게 되는데요. 미국은 플라자 합의로 달러 약세가 되면 경상적자가 어느 정도 해소될 것으로 기대했지만, 계속된 달러 약세에도 경상수지 적자가 줄어들지 않았습니다. 그래서 단기적으로 경상수지 균형을 포기하고 대신 자본수지 흑자를 통해 경상적자를 보전하는 정책으로 돌아서 약한 달러에서 강한 달러로 정책을 변경한 것이죠.

여기에서 하나의 힌트를 엿볼 수 있는데요. 세계 최대 채무국인 미국이 강달러로 돌아서게 되면 경상수지 적자가 다시 늘어난다는 의미인데 강달러를 고집할 수 있었던 것은 국제적으로 통용할 수 있는 기축통화이기 때문이었죠. 그래서 훗날 금융위기 때 천문학적으로 그림종이를 마구 찍어내었던 것이죠. 남들의 위기 때엔 허리띠를 졸라매게 만들면서 막상 자신들은 흥청망청한 겁니다.

어떻든 역플라 합의의 후폭풍은 굉장히 컸는데요. 타이를 시작으로 인도네시아, 필리핀, 한국 등 아시아 국가들에 외환위기를 겪에 되는 직접적인 계기가 되었던 것이죠. 우리네 수출입에서 모두 달러로 환전해야 하니 강달러 기조에선 갑작스레 외환보유고가 줄어들었기 때문입니다. 이때 말들이 많았었던 것이 소위 말하는 '키코'손실인 것이죠.

Comments

Post a Comment