도쿄 부동산에 대한 진실: (1) 도쿄 월세는 서울보다는 비싸지만, 북유럽, 홍콩, 런던, 뉴욕보다는 훨씬 저렴하다 (2) 도쿄의 평균 방크기는 파리보다는 크고 런던하고 비슷하다 (3) 도쿄의 마천루는 런던보다는 높고, 파리, 뉴욕보다는 낮다 (4) 도쿄의 인구밀도는 런던보다는 높고, 파리와는 비슷하며, 뉴욕보다는 낮다; 뉴욕에 비해 도쿄 부동산 가격 상승률이 낮은 이유는 1968년 제정된 New City Planning Law 때문; 이 법 때문에 도쿄에서는 12개의 거주 구획(zone)에서 복합적인 상업 및 거주 시설을 만들 수 있었다; 또한 일본은 중앙정부의 힘이 강해 건축법규 규제를 완화할 수 있었고, 연간 15,000건에 달하는 지진과 세계 최고 수준의 상속세 (55%) 때문에 집을 단기 소비재로 보는 경향이 강하다; 뉴욕 등 선진국 대도시 집값의 높은 상승세는 결국 공급의 부족 때문인데, Euclidean zoning+각종 규제 (주차장 공간, 밀도, 높이, 녹화 %)+NIMBY가 원인

https://www.konichivalue.com/p/real-estate-housing-in-tokyo-is-far/comment/10140887

This is a follow-up article to my post about how Tokyo managed to avoid an affordable housing crisis. Please read it first if you haven't already:

After writing several articles on the real-estate market in Tokyo, I constantly come across the same myths.

The most prevailing myth is that Tokyo is still the same place as it was during its bubble hay-days in the 80s: The world’s most expensive city where everyone live in futuristic shoebox-sized pods that cost more than a mansion in the US.

Another myth I constantly hear is that Tokyo is a concrete jungle that is packed with massive skyscrapers.

Thanks to the researchers at the Greater London Authority Housing and Land Commission (link to their research paper HERE), I can now put these myths to rest once and for all:

Myth #1: Housing in Tokyo is Exorbitantly Expensive

Sure, rents in Tokyo are by no means cheap, especially compared to other cities in Japan. However, you got to take Tokyo for what it is: The world’s richest and most populous city (source here).

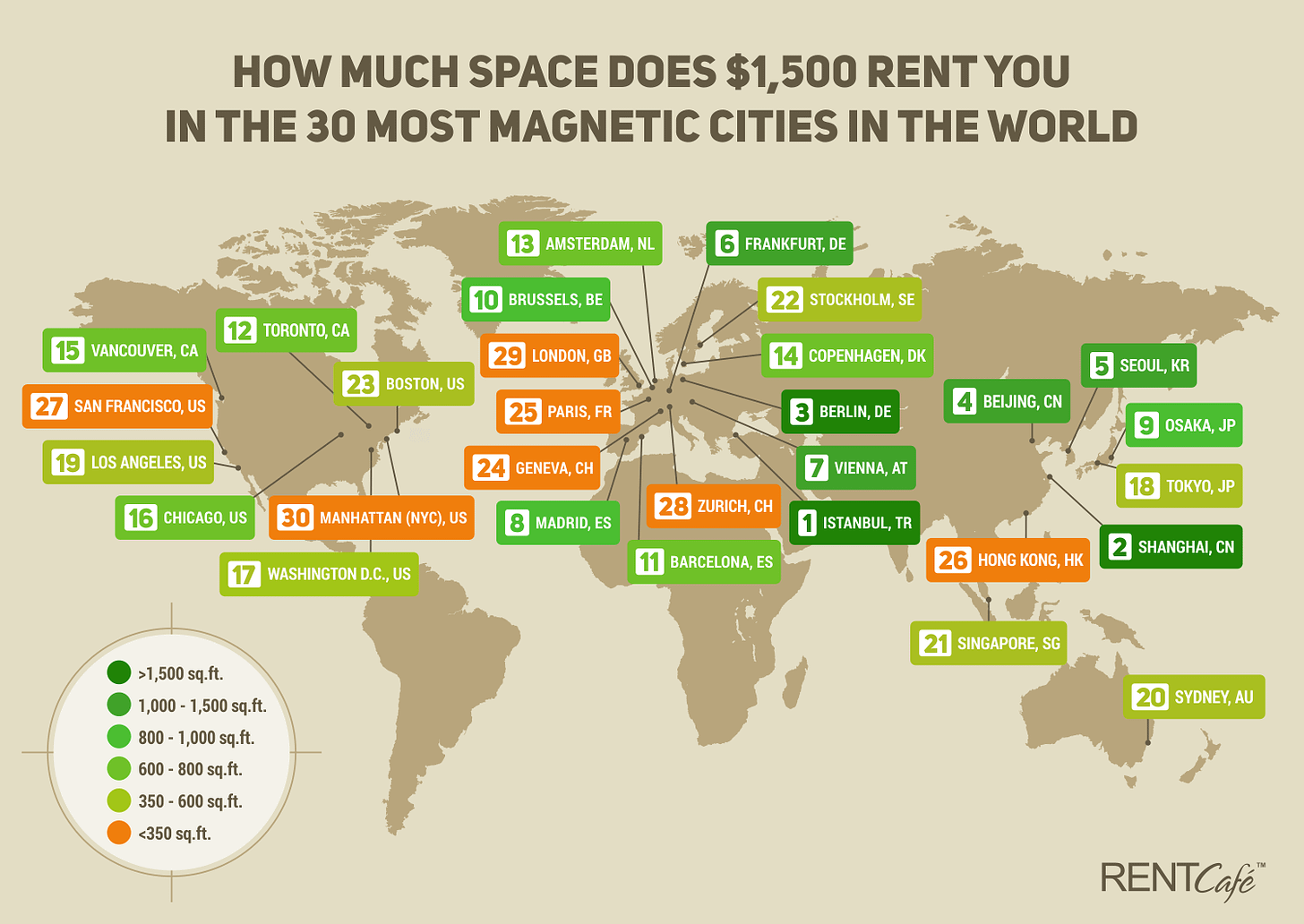

With that said, Tokyo is cheaper than most metropolises around the world:

As the graph from 2017 shows, Tokyo is substantially cheaper than New York, London & Paris. The differences in rents have only widen since then as rents have risen much faster in those cities. On top of that, the Japanese yen has been dropping substantially this year which makes the gap wider than ever.

A common counter-argument is that salaries in those cities are higher and hence, people spend a similar percentage of their income on rent. However, Tokyoites allocate around 30% of their income on rent, while 40-50% is the norm in London, Paris, and New York City (source).

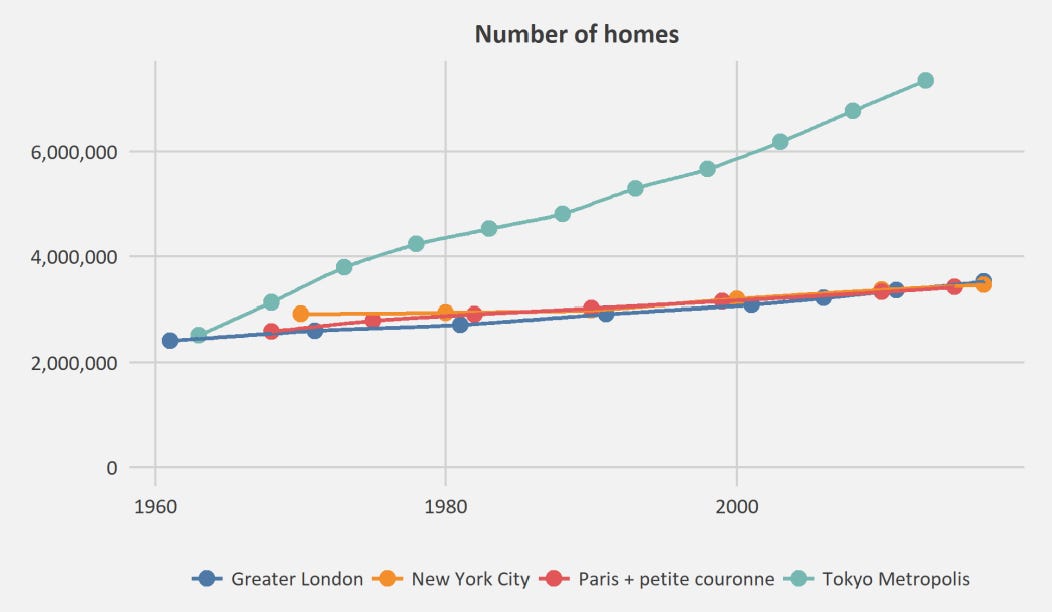

The main reason for this is that Tokyo builds so much more housing than those cities:

Since 1968, Tokyo’s housing stock has grown nearly 300%. By contrast, the other three cities have converged, although the underlying growth rates vary, with London’s housing stock having grown only by 36% since 1971, New York’s by 19% since 1970 and Paris’ by 32% since 1968.

*The reason why Tokyo’s housing stock has grown so rapidly in comparison to similarly sized cities can be found here.

Myth #2: People in Tokyo live in shoebox-sized apartments

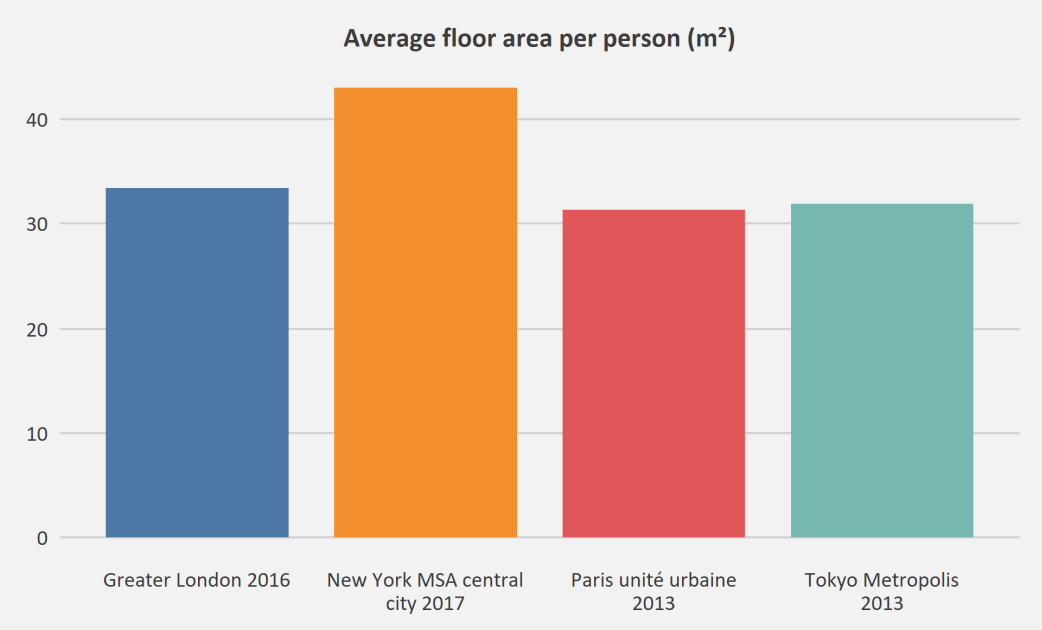

In fact, the average person in Tokyo has the same amount of floor-area as Parisians and Londoners:

On the graph above, average floor area per person has been calculated by dividing average floor area per occupied dwelling by average household size. By this measure, Paris and Tokyo have similar amounts of space per person as London, at 31 sqm, 32 sqm, and 33sqm per person respectively. Only in New York does people have more space with an average of 43 sqm in floor area. However, New Yorkers also pay far more in rent per square-meter.

Even more striking is that more people in Tokyo live in detached houses compared to apartments (30%) than in New York (16.3%) and Paris (12.3%).

Myth #3: Tokyo is a concrete jungle cramped with massive skyscrapers

Tokyo is definitely a packed city with a lot of concrete towers, but its often lower and less dense than people think. In fact, the tallest building in Tokyo is only 255 meters (not even in the top 100 of world’s tallest buildings).

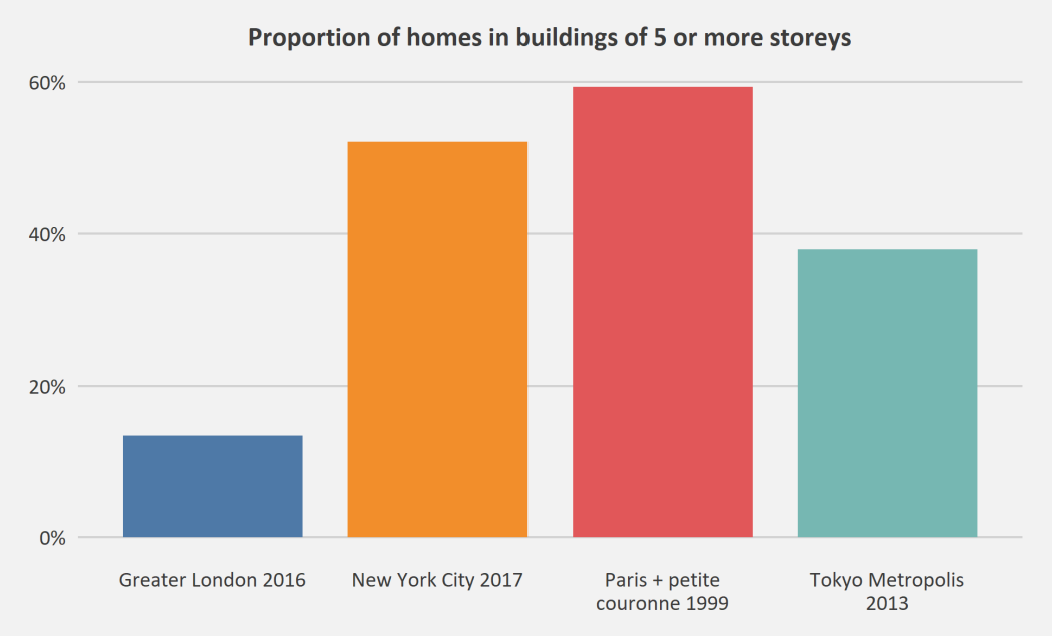

In fact, Tokyo is much lower than both New York and Paris:

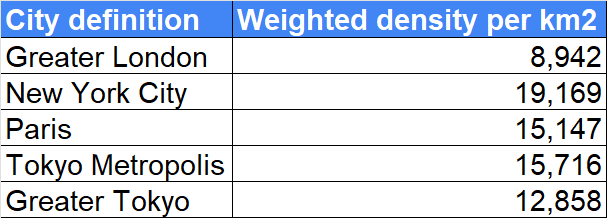

Perhaps even more shocking is that Tokyo is less dense than New York and Paris. Again, only Greater London is less dense than Tokyo:

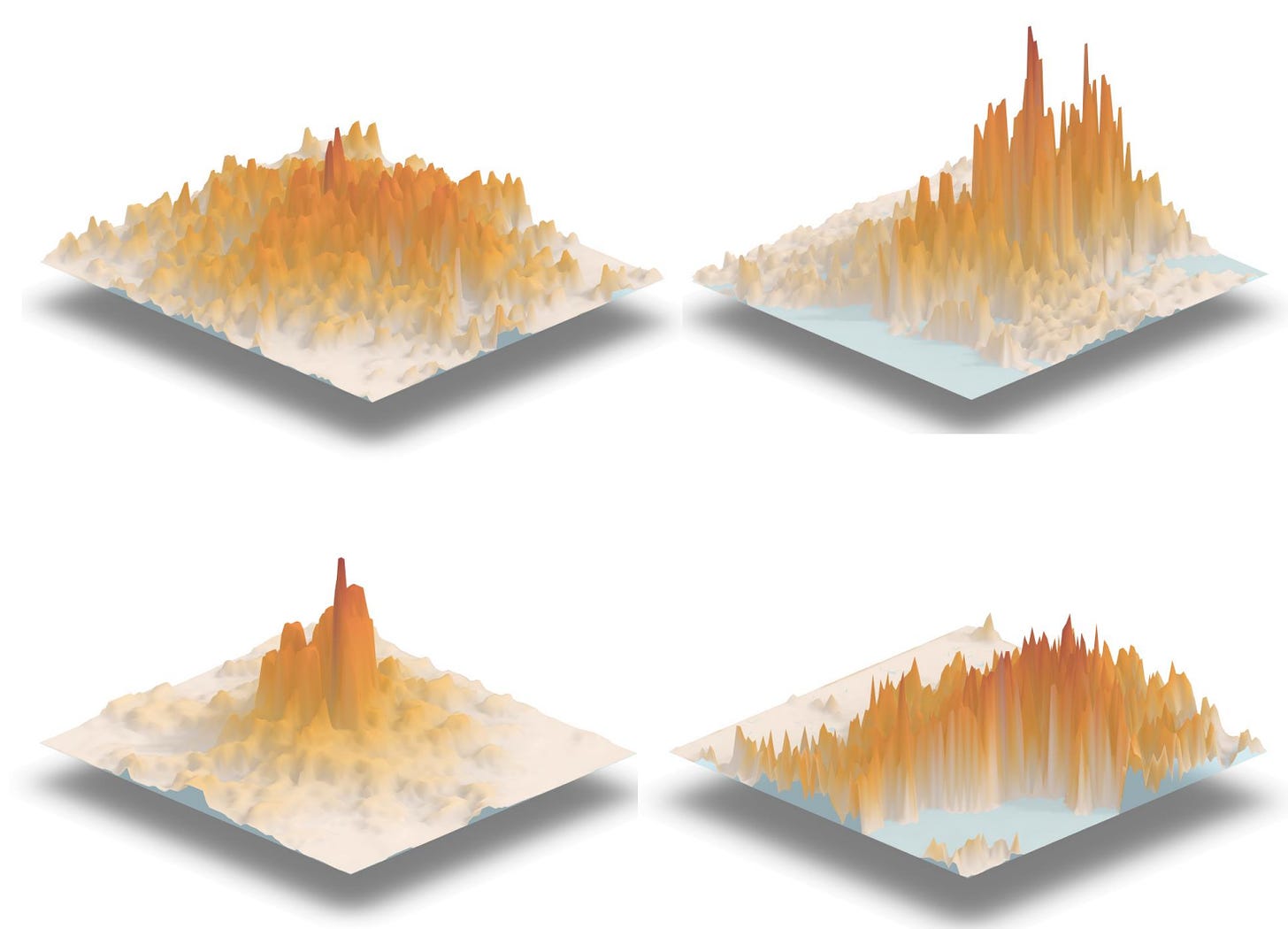

Below you can see a 3D visualization of population density with London top left, New York top right, Paris bottom left, and Tokyo bottom right:

As you can see, Tokyo is dense but not especially tall, whereas especially New York and Paris are incredibly tall and dense in the city center and very flat outside.

Conclusion

I hope this article have given some more clarity about housing in Tokyo. It’s not the capital of overpriced shoebox sized dwellings that you might have thought, but instead a very livable and affordable city.

As an investor, properties in Tokyo have underperformed compared to its peers, but even this is about to change. Prices are rising steadily here compared to its peers, especially now when we’re seeing property prices decreasing in London, New York and Paris while they are still going up in Tokyo.

At the end of the day, Tokyo is cheaper and more livable than New York, Paris and London, which is attracting a lot of people and investors. I am convinced that livability will be more and more important for a continued increase in real-estate prices, which is likely why we’ve seen more and more people and investors getting attracted to the city.

https://www.konichivalue.com/p/contrarian-investing-how-tokyo-avoided

Disclaimer: The information in this article represents my opinions, and should not be construed as personalized or individualized investment advice and are subject to change.

*A recommendation of Japanese Real-Estate Investment Trusts (REITs) are at the bottom of this article.

Tokyo is perhaps most known known for its incredible transit system, futuristic cityscape, amazing food and culture that brings visitors from far and wide.

Something you probably don't know Tokyo for is its affordable housing. Rental prices have only risen by 20% in Tokyo prefecture over the last 15 years. That's an increase in rent that many Americans and Europeans, especially in places like New York and London, are facing in a single year.

In fact, rents in Tokyo are cheaper than every major developed city, be it New York, London, Singapore, Paris, Stockholm, or Barcelona.

TL;DR

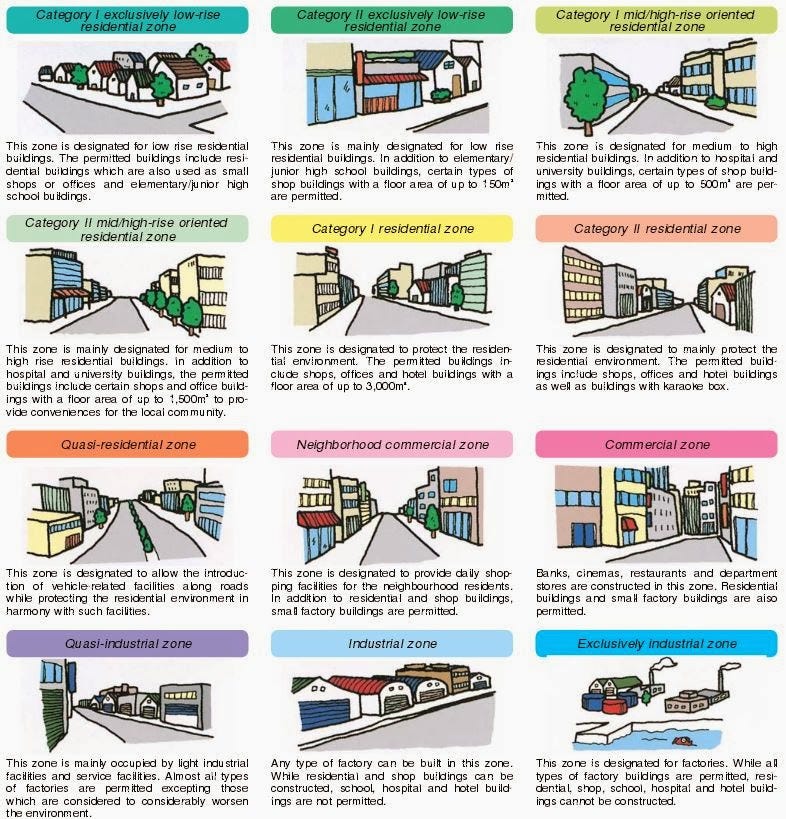

Tokyo’s affordable housing can be attributed to the Japanese New City Planning Law that was enacted on a national level in 1968. This law created 12 standardized land-use zones that covers all of Japan where apartments, restaurants and schools can be built in all but two zones. These laws have made it almost impossible for local groups to stop construction within the legal limits of the designated zone.

The US and most of Europe is ruled by Euclidean zoning, which divides each land to a specific use and is decided on a local level. This have given rise to NIMBYs (Not In My Back Yard) movements, that can effectively stop all further development in their community in favor of their property prises rising.

The difference in zoning laws between Japan and the US have led to a massive housing crunch in US cities while Tokyo's newly built housing market is thriving. America’s largest city, New York started construction on just under 30,000 new housing units in 2020 while Tokyo started constructing 130,000 units.

Due to Tokyo’s increasingly affordable housing, foreign investments have started pouring in to the city’s real-estate market. Hence, now might be a good time to invest in Japanese real-estate.

Is the declining birth-rate the reason for Tokyo’s affordable housing? Nope…

Why is the cost of living in Tokyo so stable?

News headlines might make you believe that this is due to Japan’s declining and aging population. After all, less people means less competition for existing housing.

But this isn't the case; the population of Tokyo has grown massively in the past 10 years! In fact, the population of the city grew by about 1 million people in just the past 5 years. This is a higher growth rate than New York and London, and yet rents only rose by 20% compared to over 100% for those cities.

Part of the answer is surprisingly simple, yet very complex: Tokyo has kept the cost of living at a reasonable level because a lot of housing is being built!

When you compare the households to the number of housing units, Tokyo has had more housing than households every year since 1968 and they continue to build on that surplus.

So what happened around 1968 that allowed Tokyo to be the land of housing abundance while construction in American and European cities continue to under-deliver?

The 1968 Housing Reform: The start of Tokyo’s housing boom

The story of housing in Tokyo starts with what is known as the Japanese economic miracle: The time between World War II and the end of the Cold War when the Japanese economy exploded.

The Japanese surrender in World War II brought about the end of the war and Japan was in pretty bad shape. Tons of domestic industry had been converted during the war-time to create supplies and weapons. Huge conglomerates held monopoly power over the remaining industries. There was a major shortage of housing due to air raid bombing and a lack of regulation around land use.

Right after the surrender, the United States and the allies intervened in the Japanese economy. They wrote the new Japanese constitution and they invested heavily in Japanese society. This is partly because they felt that a weak Japanese economy could lead to the rise of communism and secure Russian influence in the region. These investments and reforms was the cornerstone of the Japanese economic miracle. Massive public spending that was previously used for the military was spent on public works and Japan quickly became the second largest economy in the world.

As cities and their populations grew, lack of regulations created problems though congestion and pollution. The US and the international community wasn't just bringing money into Japan. Technological know-how and ways of organizing governments were also exchanged which greatly influenced the Japanese way of life. Part of that influence was suburbanization…

Tokyo suburbanized because that's what advanced economies did at the time. Cities grew outward as they gained population leading to urban sprawl. The Japanese government was pursuing economic growth at all costs and this led to more unchecked traffic pollution and issues with housing deficits in major cities.

The population growth was exceeding the housing market primarily due to poor city planning. Sounds familiar?

However, the Japanese government was quick to respond. In 1968, a new city planning law was passed on a national level with the goal of reforming the city planning process, curbing issues with suburbanization, and provided the foundation for Japanese zoning. This is the law that changed everything and paved the way for housing abundance in Tokyo.

Japan has a unique system of zoning that you don't really see in the United States or Europe. Look at this breakdown of Japanese zoning from the ministry of land infrastructure and transport (厚生労働省):

Most cities in the US have a complicated system with hundreds of zones for different uses. The Japanese system only has 12 zones and it encourages mixed uses. Sure, there's a zone set aside for only low rise residential use, for schools, and for intrusive industrial use. But critically, housing can be built in every single other zone. There's a zone for smaller businesses and restaurants, but if you want to build housing there you can. The same with businesses; there's a zone that allows offices and commercial buildings but housing is allowed there too.

This is because Japanese zoning is inclusive and this inclusivity has a few critical effects: First, Tokyo can build a ton of housing!

Since 1968, when the national government reformed city planning, Tokyo has had more housing than households!

Secondly, this inclusivity also allows for higher density. Tokyo can build walkable, mixed-use neighborhoods where public transit is viable, where cafes and small shops exist below apartments, where schools are just around the corner, and where religious sites are all right next to train stations. In short, places you would actually want to live and most importantly where you can afford to live.

So why aren’t more houses being built in the US? Short answer, Euclidian zoning

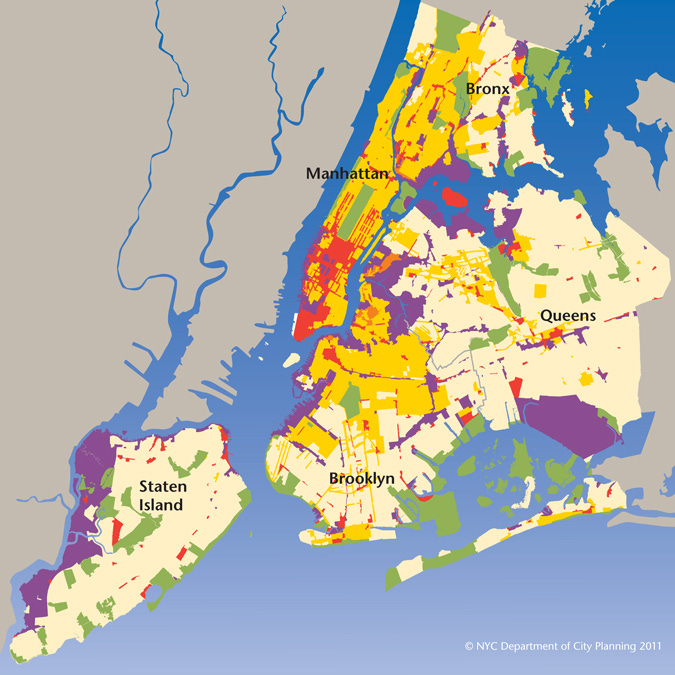

Look at this zoning map of New York city:

This is America’s most densely populated city and yet everything you see here in yellow is zoned for single or two-family use. Nothing else is allowed there!

American cities don't zone for mixed uses. Instead, they use a system called Euclidean zoning. Euclidean zoning sets aside parts of the city for exclusive single-use housing, retail, commercial, etc. This isn't just a New York city thing, this is the most common type of zoning in America…

But what happens when a city follows this pattern of zoning and the housing zones fill up? Well, for example, across New York city rents are rising as fast as 80% in one year, even for people with multi-year contracts. In fact, the rents are rising so fast that if they continue to rise at this level, only dollar millionaires will be left in most of New York.

On top of these extreme rent rises, Euclidean zoning also causes urban sprawl. Increases dependence on cars which increases pollution, makes neighborhoods unwalkable, allows for worse racial segregation, makes public transit less viable, etc. etc. you get my point…

New York city started construction on just under 30,000 new housing units in 2020. During that period, Tokyo started constructing 130,000 units and the year before that 140,000.

One study estimates the city would need 560,000 additional housing units by 2030 with an additional need for 227,000 units right now! As Tokyo is growing faster than New York, they could have been in an even more dire situation, but the government and city planners in Japan saw the writing on the wall and changed policy early.

The US can fix its housing crisis, but will likely not due to NIMBYs…

Now you might think “Okay, just change the zoning laws then? If the housing zones fill up, let's rezone and allow for more housing in other areas.”

This is known as up-zoning: Changing the zone to allow for higher density or mixed uses. But now you're stumbling upon another way that the Japanese system of zoning is unique.

In Japan, the 12 zones are determined by the national government, but in American Euclidean zoning the zones are determined locally. Enter the NIMBY movement. The NIMBY, or Not in My Back-Yard, movement is a group of existing residents and homeowners that fight new development.

Usually, under the guise of not wanting to change the “neighborhood character” they show up at local meetings and oppose new housing. Often because more housing means the value of their property won't continue to rise.

However, in Tokyo there is no NIMBY movement. Land use is determined mostly by the person who owns it. Community input on new housing isn't requested and nobody expects their opinion on what their neighbor is building to matter.

The fact of the matter is that American cities can have affordable housing, it just requires making the right policy choices. In 1968, the Japanese government made those choices and decades later Tokyo is the land of housing abundance. Meanwhile, look at any American city to see the impact of Euclidean zoning: Rents continue to rise even in mid-sized cities let alone the biggest city in the country lack of housing is forcing people out of city life. More and more Americans are becoming rental cost burdened and they do so at the pleasure of existing property owners who all too often think that building affordable housing is important, they just don't think it should be built where they live…

But in Tokyo housing is being built where people live, wheter they want it or not, and the city is better off for it! The sooner American cities can learn that lesson the better.

How can you invest in Japanese real estate?

Even though yeild from real-estate in Japan has been stagnent, this is set to change in the coming decade. In 2021, the amount of investment by overseas investors reached 1,330 billion JPY, an increase of 30% from the previous year. This is the first time in history the investment amount from foreigners has exceeded 1 trillion JPY.

I created a guide on how you can invest in Japanese housing here:

However, if you are after buying in Japanese housing purely for investing, I recommend looking at Japanese Real-Estate Investment Truts (REIT).

All major Japanese REITs can be found here. For me, the most interesting REITs are:

Invincible Investment Corp [8963]: Invincible Investment Corp is a real estate investment trust (REIT) which invests in securitized real estate products. Invincible Investment Corp invests primarily in hotel and residential assets.

Heiwa Real Estate REIT Inc [8966]: A real estate investment trust (REIT) which invests in real estate and securitized real-estate products. The Company mainly invests in office and residential buildings in Tokyo metropolitan area.

1. 상속세와 지진

- 세계 최고 수준의 상속세 (55%)

- 지진: 연간 15,000건

- 집을 소비재로 여김

Homes are not built to last; and that's the point.

1% of housing are older than 1951.

2. 탈규제

- 주차장 공간, 밀도, 높이, 녹화 %를 따지는 다른 선진국들과 다르게 규제가 약함

- NO NUMBY: 중앙정부의 힘이 막강

3. 부작용

Green Space

- 런던: 33%

- 뉴욕: 27%

- 도쿄: 7%

Comments

Post a Comment